mortgage interest rates forecast

Understanding Mortgage Interest Rates Forecast

Mortgage interest rates forecast helps homeowners, buyers, and investors understand how much it might cost to borrow money for a home in the future. These forecasts are based on economic trends, inflation, government policies, and housing market conditions. For someone planning to buy a home, keeping an eye on mortgage interest rates forecast can save a lot of money over the years. By knowing the expected rates, buyers can decide whether to lock in a mortgage now or wait for a better rate. Experts analyze trends from previous years, including mortgage interest rates forecast 2021, 2022, and 2024, to predict what might happen in 2025 and 2026.

Mortgage Interest Rates Forecast 2026: What Experts Are Saying

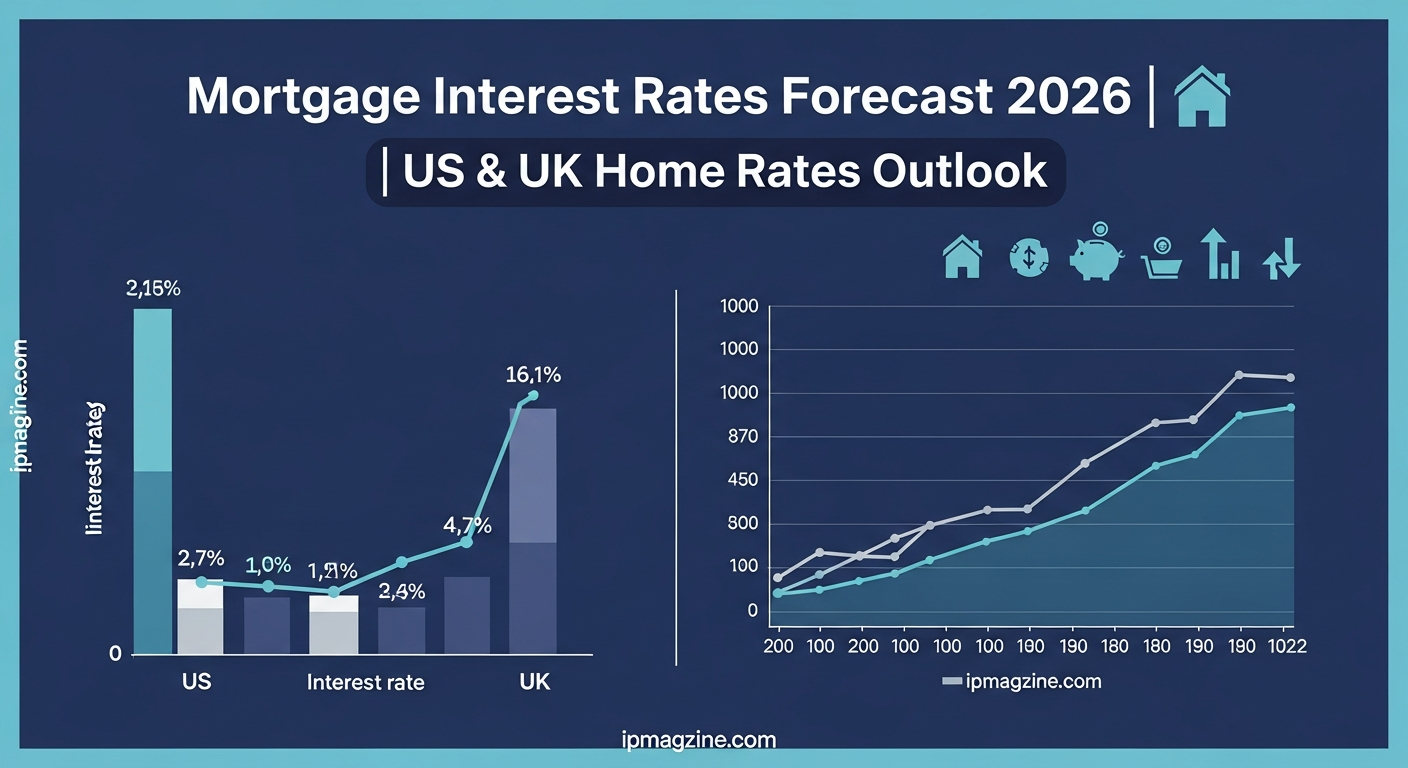

The mortgage interest rates forecast 2026 shows a potential increase in rates for both the US and UK markets. Economists predict that inflation pressures, global economic recovery, and central bank policies may push home mortgage interest rates forecast slightly higher than in previous years. Homebuyers planning to secure a loan in 2026 should monitor the rates carefully. While rates are expected to rise moderately, locking in a mortgage early might be a smart strategy for those looking to save on long-term interest payments. The forecast considers current us mortgage interest rates forecast and historical trends to provide a realistic outlook.

Mortgage Interest Rates Forecast 2025: Preparing for Next Year

For 2025, the mortgage interest rates forecast indicates a stable but slightly upward trend in rates compared to 2024. The us mortgage interest rates forecast 2025 suggests that borrowers might face higher monthly payments if they delay applying for a mortgage. Similarly, the uk mortgage interest rates forecast 2025 predicts a moderate rise due to economic recovery and inflation control measures. Understanding these forecasts helps homeowners plan their budgets and avoid surprises when it comes time to refinance or buy a new home. Analysts also use data from mortgage interest rates forecast 2022 to compare trends and improve predictions for the next year.

Home Mortgage Interest Rates Forecast: Why It Matters

Home mortgage interest rates forecast is essential for both first-time buyers and experienced homeowners. Knowing the expected rates can influence whether you choose a fixed or variable mortgage, how much down payment to make, and the loan term that best fits your financial goals. The mortgage interest rates forecast us market shows that rates are influenced by the Federal Reserve’s decisions, while uk mortgage interest rates forecast 2025 depends on the Bank of England’s policy. Keeping an eye on these numbers ensures that you make informed decisions and secure the best possible mortgage deal for your home.

Current US Mortgage Interest Rates Forecast

The current us mortgage interest rates forecast indicates rates have been gradually rising due to inflation and changes in government monetary policies. Homebuyers should note that even a small increase in interest rates can significantly affect monthly payments and total interest paid over the life of the loan. Mortgage lenders are watching economic indicators closely to adjust their rates. By studying historical data such as mortgage interest rates forecast 2021, 2022, and 2024, potential borrowers can better understand how rates might move and plan their mortgage applications accordingly.

Mortgage Interest Rates Forecast 2024: A Quick Look Back

Mortgage interest rates forecast 2024 provides insights into how rates evolved and why they changed over the year. Rising inflation, economic recovery after global disruptions, and central bank decisions played major roles in shaping the forecast. Homebuyers who studied mortgage interest rates forecast 2024 were better prepared to act when rates were favorable. This historical perspective helps predict mortgage interest rates forecast 2025 and 2026, as trends often continue for several years. For investors and homeowners, these forecasts are invaluable in making smart decisions regarding refinancing or purchasing new properties.

Mortgage Interest Rates Forecast 2022 and 2021: Lessons Learned

Looking at mortgage interest rates forecast 2022 and mortgage interest rates forecast 2021 helps understand patterns in the housing market. During these years, rates were affected by economic uncertainty, stimulus packages, and market recovery. Many homeowners locked in lower rates during this period, benefiting from savings on interest payments. Learning from these forecasts can guide future borrowing decisions, as economic factors that affected rates in 2021 and 2022 may reappear or influence future trends. Historical data combined with expert analysis provides a roadmap for predicting mortgage interest rates forecast us and other markets.

US Mortgage Interest Rates Forecast: Trends to Watch

The mortgage interest rates forecast us market continues to depend on economic growth, inflation, and policy decisions. Forecasts indicate that rates will slowly rise over the next few years, reflecting a recovering economy and efforts to manage inflation. Homebuyers and investors should watch trends closely, as timing can impact loan affordability. By comparing the mortgage interest rates forecast 2025 and 2026, borrowers can plan strategies such as refinancing, early payment, or locking in rates to minimize costs. Understanding these trends ensures homeowners are not caught off guard by rate fluctuations.

UK Mortgage Interest Rates Forecast 2025: What Buyers Should Know

The uk mortgage interest rates forecast 2025 shows a moderate increase compared to current rates. Factors such as inflation control, economic recovery, and housing demand affect these predictions. Homebuyers should be aware that mortgage rates in the UK can differ significantly from the US due to economic policies and central bank strategies. Comparing trends like mortgage interest rates forecast 2024 and 2025 can help buyers plan the best time to secure a mortgage. This forecast is crucial for anyone looking to buy property in the UK, ensuring they make informed financial decisions and reduce long-term borrowing costs.

Home Mortgage Interest Rates Forecast: Planning Ahead

Planning ahead with a home mortgage interest rates forecast ensures borrowers make smart financial choices. Forecasts help decide whether to choose fixed-rate or variable-rate mortgages, determine the right loan term, and understand potential future payments. Analyzing mortgage interest rates forecast us and uk markets allows homeowners to compare options and predict how changes in interest rates could affect their monthly payments. Staying informed gives borrowers confidence and prevents unexpected financial stress while buying or refinancing a home. Historical and current forecasts combined create a reliable guide for making mortgage decisions.

Conclusion

Mortgage interest rates forecast is an essential tool for anyone planning to buy or refinance a home. Understanding the trends from previous years such as mortgage interest rates forecast 2021, 2022, and 2024 helps predict what might happen in 2025 and 2026. Experts suggest rates may gradually rise in both the US and UK markets, influenced by inflation and government policies. By keeping an eye on current us mortgage interest rates forecast and comparing them with past predictions, homebuyers can make informed decisions. Planning ahead ensures borrowers choose the right mortgage type, secure favorable rates, and manage monthly payments effectively. With the right knowledge, buying a home becomes easier and less stressful.

FAQs

What is a mortgage interest rates forecast?

A mortgage interest rates forecast predicts how mortgage rates may change in the future based on economic trends, inflation, and central bank policies.

Why should I follow mortgage interest rates forecast 2025 and 2026?

Following forecasts helps homebuyers plan the best time to buy or refinance and avoid paying higher interest over the life of the loan.

Are mortgage interest rates forecast the same in the US and UK?

No, rates differ because they depend on each country’s economy, inflation, and central bank decisions.

How accurate is a mortgage interest rates forecast?

Forecasts are predictions based on historical data and current trends. While not exact, they provide a useful guide for planning.

Can I save money by following mortgage interest rates forecast?

Yes, understanding trends allows borrowers to lock in favorable rates, reduce interest payments, and plan their mortgage better.